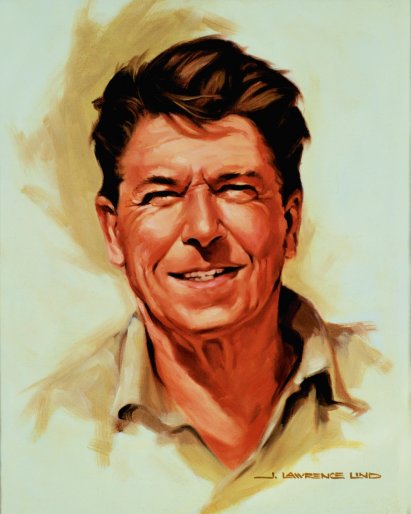

Sen. Claire McCaskill (D-Missouri) summoned Ronald Reagan’s ghost to visit the Tea Party:

McCaskill said:

Published on Sep 27, 2013

Former President Ronald Reagan explaining the importance to American jobs and businesses of Congress living up to its financial obligations and paying the country’s bills.

(Hey, are Congress people getting the hang of internet video, finally? Could teachers be far behind?)

More:

- Debt ceiling explanation

- “Debt Limit Explained,” super teacher CGPGrey

- CBS Money Watch, Debt ceiling, what’s at stake

- Bloomberg News, 5 reasons to fear the debt ceiling

- “Debt ceiling explained,” 2011 story from NPR’s Planet Money project

- Rolling Stone’s Matt Taibbi, The Mad Science of the National Debt

- Life-Size Statue Of Ronald Reagan Torched In Temecula (losangeles.cbslocal.com)

- Klein: Baby Boomers Ruined The Government (content.time.com)

- Government by Tantrum (athomesense.com)

- 2011 debt deal described at The Economist, “No thanks to anyone”

[…] Ronald Reagan’s message to the Tea Party on the debt ceiling: Fail to raise it “an outra… (timpanogos.wordpress.com) […]

LikeLike

“To quote: argue, as Black Flag is arguing here, that this is not wise management of money.”

No, James, you are the hypocrite.

It is you who champions more debt, yet screams that if others did not hearld a warning during Rep. days, we are hypocrites.

But poor James. We did.

Taxes and debt are destroying the nation. If you’d actually read a post or two, that is what Morgan and I have said – independent of the idiots in power.

The problem is people like you.

You champion the thieving when you benefit.

You cry about the thieving when others benefit.

You are not against the thieving, you are merely disappointed when you are not the winner.

Yet, it is the thieving that it killing the country. You are blind to it.

LikeLike

Actually, the debts are NOT being repaid at all.

They are being “rolled over” and expanded. Again, Ed, your financial and economic illiteracy dogs you. You do not claim we are paying off debt when the debt gets larger.

It is not normal in any large organization or they fail. No organization continues to increase debt without risk of bankruptcy. Your claim shows how little you know about organizations.

The only “means” is a continued pilfering of the people, which will destroy the economy even more. The only “means” is absolute default.

It is not like a family. Government produces nothing and pretending it is a family is obscene.

It is impossible for the US to cover its debt.

Impossible.

Absolute default is inevitable.

Oh, and Ed, you err’d in your history, claiming the US has never defaulted.

-The Continental Currency Default of 1779

This first default resulted in a cumulative loss of approximately $7 billion dollars to the American public.

-The Default on Continental Domestic Loans

By the Funding Act of 1790, Congress repudiated these loans entirely, but offered to convert them to new ones with less favorable terms, thereby memorializing the default in the form of a Federal law.

-The Greenback Default of 1862

January of 1862, the US Treasury defaulted on these notes by failing to redeem them on demand.

-The Liberty Bond Default of 1934

Liberty Bond, dated October 24, 1918, which was a $7 billion dollar, 20-year, 4.25 percent issue, payable in gold at a rate of $20.67 per troy ounce.

By the time Franklin Roosevelt entered office in 1933, the interest payments alone were draining the treasury of gold; and because the treasury had only $4.2 billion in gold it was obvious there would be no way to pay the principal when it became due in 1938, not to mention meet expenses and other debt obligations.

Roosevelt decided to default on the whole of the domestically-held debt by refusing to redeem in gold to Americans and devaluing the dollar by 40 percent against foreign exchange. By taking these steps the Treasury was able to make a partial payment and maintain foreign exchange with the critical trade partners of the United States.

If we price gold at the present-day value of $1,550 per troy ounce, the total loss to investors by the devaluation was approximately $640 billion in 2011 dollars.

-The Momentary Default of 1979

The Treasury of the United States accidentally defaulted on a small number of bills during the 1979 debt-limit crisis. Due to administrative confusion, $120 million in bills coming due on April 26, May 3, and May 10 were not paid according to the stated terms. The Treasury eventually paid the face value of the bills, but nevertheless a class-action lawsuit, Claire G. Barton v. United States, was filed in the Federal court of the Central District of California over whether the treasury should pay additional interest for the delay. The government decided to avoid any further publicity by giving the jilted investors what they wanted rather than ride the high horse of sovereign immunity. An economic study of the affair concluded that the net result was a tiny permanent increase in the interest rates of T-bills.

And of course, the great default in 1971, when Nixon closed the gold window, reneging on the payments of gold for dollars.

LikeLike

To quote: argue, as Black Flag is arguing here, that this is not wise management of money.

He and his fellow teabagger Morgan can argue “fiscal responsibility” when they and their party agree to get rid of the tax cuts for the rich, agree to force businesses to pay taxes, end all that corporate welfare, and oh yes..take a scalpel to the US military.

Until then they are nothing but hypocrites and aren’t worth listening to.

Oh and Black Flag..where in hell was your concern for the debt when your party was running up the vast majority of it?

Sorry, child, your opposition to the ACA and all the rest has nothing to do with “fiscal responsibility” it has to do with “The scary black man in the White House” otherwise known as “Republicans suffering from Obama derangement syndrome”

LikeLike

Actually, the debts are being repaid all the time. Because of money needs, there are periods when debt is accumulated in order to pay off other debts.

This is normal in any large organization, and is not a problem so long as there is cash flow and means to pay the debts.

The U.S. has the means. The debt ceiling flap may cut off the cash flow, and force a stupid default. It’s rather like a two-income family, and one member gets laid off from his job. The couple may take out a loan-consolidation loan from a bank, to better manage payments. One can argue that they are taking on new debt — true — and one may oddly argue, as Black Flag is arguing here, that this is not wise management of money.

However, it avoids default and bankruptcy. When the laid-off household member snags a new job, debt can be paid down faster.

Rarely is a hiccough in cash flow a good reason to default, absent other issues that make payments impossible.

The U.S. has plenty of means to pay off enormous, staggeringly huge debts, and we are managing cash well, now. Consequently, it would be foolish to decide to stop making payments, when we have the means to do it.

LikeLike

You are not paying of debt by borrowing and increasing debt, Ed.

Stop being so stupid.

LikeLike

Every dollar borrowed since 1775 has been repaid by the U.S. government (Stephen Girard’s donation excepted).

238 years of repaying borrowed dollars.

History has no meaning to you, Black Flag? The credit bureaus pay attention, at least.

LikeLike

“Bonds were sold for 10 years in 1917. Any of those bondholders stiffed? No.”

That is utterly irrelevant, Ed.

Every dollar the government borrows will never be repaid.

Your economic and financial idiocy pretends that borrowing more money is repaying debt.

Only idiots make the arguments you make, Ed, and thus Great Fools

LikeLike

Bonds were sold for 10 years in 1917. Any of those bondholders stiffed? No.

How long have we allowed 30 year bonds?

Since 1789, has any holder of U.S. Treasury bonds ever failed to be paid back, on time, with full interest?

No.

I may well be an economic idiot. But hoax claims like yours won’t reveal it.

LikeLike

Ed, don’t worry your little head about my age. Odds are, I’m older and wiser and smarter then you.

.

“In that time we retired much of the debt and were on a path to completely pay it all back by 2011”

Utter Bullcrap.

You are utterly devoid of facts.

Ed, you are a fool. You think your empty proclaims go unchallenged??? Man, get a brain.

Only to a complete moron can one claim “we are retiring debt” while it grows.

“In any case, we were close to paying it off, as we were before in the Kennedy administration.”

Are you sick in the head?

Adding trillions a year to the debt – to you – means we are close to paying it off???

You pretend payments of debt by making more debt is paying of debt.

You are economically AND financially moronic.

“Dollars borrowed don’t degrade the economy if they build the economy. How would we know dollars are degraded? The usual economic indicator is high inflation.”

Bull.

You are an economic idiot – borrowing does not influence inflation. Increasing the money supply increases inflation.

LikeLike

[…] Ronald Reagan’s message to the Tea Party on the debt ceiling: Fail to raise it “an outra… (timpanogos.wordpress.com) […]

LikeLike

Another speech from Ronald Reagan on the debt ceiling:

LikeLike

BF, you probably are too young to remember Bill Clinton’s administration. In that time we retired much of the debt and were on a path to completely pay it all back by 2011 — when George W. Bush got enthralled by the idea we shouldn’t pay it off, but should instead take the money intended to pay it off, and give it to rich people.

In any case, we were close to paying it off, as we were before in the Kennedy administration. Certainly you’re too young to remember that, and you probably attended school in the Bush II years and so didn’t learn that history.

All of those bondholders in the Kennedy administration were paid off. Law required then that bondholders be paid within 10 years. Now it’s 30 years — but every bondholder who bought 31 years ago has been paid off, and no debt remains that is older than 30 years.

So, yes, the U.S. has a more than 200 year history of paying it all off (with only the Stephen Girard exception — but he excused the debt in gratitude for the nation that took him in and let him get rich without forcing him to take a religion).

You don’t get your own set of facts. Every debtor the U.S. has ever had, has been paid back to this point, 99% of them paid pack in full. The other 1% bought in more recently.

Dollars borrowed don’t degrade the economy if they build the economy. How would we know dollars are degraded? The usual economic indicator is high inflation.

I’m sure you’re not looking, but we don’t have high inflation now — in fact, some economists think inflation is too low.

LikeLike

“I can look at the U.S. Savings Bonds I bought as a kid, and got paid back for. I can look at the U.S. Savings Bonds our kids bought, and used for college.”

Don’t be obtuse.

Replacing a debt with more debt is NOT paying it off, and you know it. Moving your mortgage to your credit card does not pay off “debt” – it merely transfers it.

Yeah, you are playing the game of the “Greater Fool” – but that doesn’t pay off debt – which is your contention.

The government has made its interest payments – by borrowing, Ed.

Making your interest payments on your mortgage with your credit card may keep you solvent, but it does not pay off your debt.

As usual, your economic illiteracy exposes you.

LikeLike

I can look at the U.S. Savings Bonds I bought as a kid, and got paid back for. I can look at the U.S. Savings Bonds our kids bought, and used for college.

I can look at the Treasury reports, and and history — never a default, payments always made.

Where did you get the idea that these debts aren’t solid? The markets say the only problem is political idiots — present company excepted? — who may drive Congress to default for no good reason.

LikeLike

“Since 1789, every dollar the U.S. has borrowed has been repaid.”

What absolute crock. Are you living on this Earth or some other dimension?

How can you claim its been repaid when the debt – on and off the books – exceeds $200 trillion?

Businesses borrow to expand production. Just because you point to a handful of companies that do not borrow means nothing, since you are blind the the thousands of other companies that do.

You are economically illiterate and know little of what you talk about.

LikeLike

Since 1789, every dollar the U.S. has borrowed has been repaid.

History and economic illiterates, and terrorists, claim otherwise.

Businesses borrow to even out cash flow, and to build. Exxon-Mobil, Apple, Google and Microsoft, maintain massive lines of credit and billions in loans.

Black Flag doesn’t know what he’s talking about.

LikeLike

Reagan was no different from Obama or any other Prez – preach one thing, do another.

LikeLike

I’m pretty sure St. Ronald never said anything like that. I have it on the best authority (read it on the ‘net) that Obama got into his handy Acme Time Machine, and traveled back to the past to fiddle with the recording.

LikeLike

.

LikeLike

Economic illiterates do not understand that every dollar government borrows will NEVER be repaid.

Further, they do not understand that every dollar government borrows degrades the economy, for it takes that dollar away from the market who are the only ones that actually create wealth and prosperity.

The devastating consequences of these things are lost on Ed and his team.

LikeLike